Typically genre literature refers to genre fiction, which in turn is used to call novels with similar elements or narrative styles like books of science fiction, fantasy novels, detective thrillers, and mysteries. As we entered the 2010s, the market for e-books and web novels which represent digital publishing content rapidly grew and genre fiction has been shaking up the conventional literature scene ever since. In South Korea, web novels centering on genre fiction appeared in earnest in January 2013 on Naver’s web novel service.

What sets web novels apart from conventional novels is the fact that their formats can vary depending on the author’s situation. Usually, readers have to pay for each chapter in the novel, so authors base their stories on fun and suspense. Needing to keep readers hooked, events in web novels happen quickly in short amounts of time. Also, as increasingly more users read web novels on their smartphones, sentences have evolved, becoming easier to read on smaller screens and authors rely on vivid details to keep readers going. Writers also use more dialogue to narrate situations and characters.

Cheap and easily accessible, web novels are also representative of snack culture that’s quickly read and consumed. Due to these market conditions, the South Korean web novel market has grown exponentially. According to the Korea Creative Content Agency, the South Korean web novel market value amounted to 400 billion won in 2018. This would mark a 150 percent growth in a year, as the market in 2017 was estimated to be around 270 billion won. When compared to where the market was in 2013 at 10 billion won, the market has grown 40 times its size over the past five years. The growth in the market has also led to the growth in jobs for web novelists. In 2018, there were 26 writers who made over 100 million won by working as an official web novelist for Naver. The writer who earned the most was estimated to have taken home 470 million won when taking into account profits from previews and manuscript fees.

Then what types of web novels are read most in South Korea? According to Naver Webtoon which runs the web novel platform, as of August 2019, 107 web novels were being serially posted, and 56 of them (52.3 percent) were romance novels whereas 29 (27 percent) were romance fantasy novels. At Kakao Page, which shares the web novel market almost evenly with Naver, things were quite similar. Of the 3,628 novels being serially uploaded, 1,234 (34 percent) were fantasy novels while 1,019 (28 percent) were romance novels. This was largely attributed to web novel readers’ preferences for light and fun reading material.

What sets web novels apart from conventional novels is the fact

that their formats can vary depending on the author’s situation.

Introduction to main web novel platforms

Web novel platforms for genre fiction usually refer to websites or mobile apps where web novels are posted chapter by chapter online. In the 1990s, web novels were usually posted on online boards for fantasy and science fiction. In the 2010s as the usage of smart devices proliferated, platforms and ways to use those platforms have all changed. Web novel platforms first appeared in the 2000s. Munpia and Joara which are still in operation today can be called first-generation web novel platforms. As the market for web novels grew, so did the number of web novel platforms, but readers are concentrated on popular platforms that are famous and have more writers and readers. Well-known web novel platforms in South Korea would include Kakao Page, Naver Web Novels, Munpia, Joara, Tocsoda, Ridibooks, Millie’s Library, Mr. Blue, One Store, Bookpal, Snackbook, Romantique, and Blice. Below are explanations of each business and related issues.

Kakao Page

page.kakao.com

This web literature service provides readers with webtoons, web novels, web dramas, dramas, and movies. The number of registered users stood at 3.3 million in 2013 and jumped to 22 million in the first half of 2019. In the first six months of 2019, the number of hits on written work on Kakao Page measured around 44 billion. Kakao Page is a mobile app and service provided by Kakao. It is operated by Kakao Page Co Ltd. Kakao Page has utilized its ‘wait until it’s free’ marketing strategy with much success. The number of written works published on Kakao Page including webtoons, comics, novels, and bestsellers amounts to around 62,000. More than 3,500 of these have been provided to readers through the ‘wait until it’s free’ marketing strategy. Kakao Page became a content business subsidiary of Kakao in December 2015. In 2016, it succeeded in turning an annual profit and has seen only success since. In 2018, the company recorded annual sales of 180 billion won and 220 billion won in users’ transaction payments.

Naver Web Novels

novel.naver.com

Naver Web Novels is a web novel service that has been operated by Naver Webtoon Co Ltd since May 2017. Centered around genres including romance, romance fantasy, fantasy, and martial arts, the service offers different chapters of web novels written by professional writers every day of the week. It operates a ‘promotion’ system where writers and their work are divided between the Challenge League and the Best League. The Challenge League is a board for creative work where anyone who wishes to become a genre fiction writer can upload their writing. To become promoted to the Best League, writers must have previously uploaded their work on Challenge League, and every month, new pieces of work are selected based on their popularity, consistency in serial uploading and other management standards. Challenge League work categories include romance, fantasy, martial arts, mystery, history and war, and light novels. As Naver Webtoon saw the birth of many new webtoon artists, Naver Web Novel is also working on energizing the genre fiction industry in South Korea and discovering new writers.

Munpia

www.munpia.com

Munpia is another web novel website where novels are uploaded by chapter. Their slogan is, ‘The utopia of web novels, the world of writing Munpia’. It began as a community website in 2002 and grew into a listed company offering pay-to-read services in 2013. As a website specializing in web novels, it mainly offers genre fiction like fantasy and martial arts novels. As of 2018, monthly page views on average reached over 100 million with website visitors amounting to around 400,000. Annual sales at Munpia were around 5 billion won in 2014. They soared to 19 billion won in 2016, and 27 billion won in 20167. In October, Munpia received equity investments worth 25 billion won from China’s largest web novel platform, China Literature Limited (CLL), and South Korean gaming company NC Soft.

Joara

www.joara.com

What began as a web novel community in 2000 has now grown to become the country’s biggest web novel platform with over 500,000 works of literature in its database. The website’s paid subscription service called ‘Noblesse’ is currently serving as a gateway of sorts for writers to prove their ability in the web novel market. Joara has 1.3 million members, 150,000 writers, 9.5 million daily views, and 2,600 daily updates. Recently it has also been making efforts to enter markets outside South Korea. In 2019, the website carried out content export negotiations with countries including Thailand, Indonesia, Taiwan, China, and Turkey to distribute its popular web novels globally.

Tocsoda

www.tocsoda.co.kr

Tocsoda is operated by one of the country’s biggest bookstore chains, Kyobo Book Centre. The name is an abbreviation of ‘all the piquant web novels are here’ in Korean. Every month, the website selects five to ten freely submitted web novel series and awards the authors with 1 million won each as part of a policy called “Super Rookie Support”. A web novel competition hosted by Tocsoda called “Show Me the Fandom” sought to set itself apart from conventional judging processes usually comprised of money prizes and an internal selection process carried out by professionals. All the novels submitted to the competition were offered to readers for free and readers in turn, freely offered their feedback. Prospective web novelists were cheered on by the fact that readers would be directly selecting the work to be awarded and also handing out the prize money. During the contest period, around 4,000 writers applied to become members of the website while over 3,500 novels were submitted. Tocsoda has said its goal is to create a good environment for writers to carry out their work while readers can comfortably read stories.

Tocsoda app

Ridibooks

ridibooks.com

Ridibooks began as an e-book store operated by Ridi Co Ltd in November 2009. The website sells regular books like bestsellers, comics and web novels involving romance, fantasy, and martial arts. Users can purchase e-books and download them onto their smartphones, tablets or PCs. As of March 2019, Ridibooks offered more than 2 million books, and the number of accumulated downloads stood at over 500 million. As of May 2019, the number of members at Ridibooks was 3.7 million, while in 2018 alone, the website saw nearly 840,000 new members join its website. Ridibooks has the biggest market share in South Korea’s e-book market. It has affiliated itself with roughly 2,550 publishers and has 2.13 million e-books offered in terms of content. The company has attracted a total of 33.5 billion won in investments so far.

Millie’s Library

www.millie.co.kr

Launched in July 2016, Millie’s Library has the largest reading subscription service in South Korea. It has been acknowledged for its efforts in expanding the reading content market in the digital age by offering a wide variety of secondary content in addition to its some-40,000 e-books, like the world-first reading service via chatting called ‘chatbook’ and 30-minute audiobooks read by famous celebrities. Millie’s Library also offers reading content called ‘Millie Original’ where the company plans and produces exclusive reading content. This has included ordinary novels, essays, and children’s books like ‘Pink Fong Fairy Tales’ to reach readers with a plethora of content.

Millie’s Library app

Book Cube

www.bookcube.com

Book Cube began offering its services in 2008, and it is a digital content distributing platform with over 600,000 e-books, around 40,000 web novels, and over 1,000 webtoons. In February 2019, it launched its own publishing brand called AURORA, with the goal of providing “romance just for you” and has been exclusively publishing work by new and experienced authors since.

BritG

britg.kr

BritG is a web novel platform that encourages the participation of users created by publisher Golden Bough. It was opened in beta form in February 2017 before taking on its current form. If most online novel platforms largely handle full-length novels, BritG differentiated itself by specializing in short-to-mid length novels. It has also set itself apart from other similar services by operating many literary prizes, creating a review culture, and actively taking part in the editing process. More than 7,000 pieces of work have been registered on the website, and of these, some-50 full-length and short novels are awaiting publication while some have already been published in paper form. After creating a unique reviewing structure through review contests and review requests, BritG has connected that to creative writing. Every month, it selects the best reviewer, and that person is given a book and gift certificate as a prize. Outstanding reviews are separately displayed, and writers can request one-on-one reviews from top reviewers or receive reviews en masse from users.

Blice

www.blice.co.kr

South Korea’s largest phone company KT opened Blice in July 2018 as a provider of web novels about romance, fantasy, martial arts, and other topics. The website offers users with book recommendations based on big data, and it was the first to utilize blockchain technology to protect key information within the platform. The website operators have stressed Blice is a safe platform where writers and users can make transactions safely.

Platforms that specialize in web novels are ramping up their investments to secure writers and readers,

using that money to find differentiated content and marketing models.

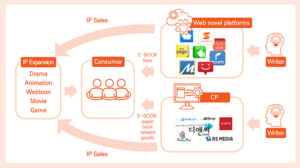

Growth in South Korea’s web novel market is expected to continue. The number of talented writers with professional abilities in a number of genres is also expected to increase. The reader population of web novels is growing as the ‘smart’ media environment is becoming an everyday trend. Platforms that specialize in web novels are ramping up their investments to secure writers and readers, using that money to find differentiated content and marketing models. The content from web novels is increasingly being expanded and success stories multiplying, like <What’s Wrong With Secretary Kim? (Gaha)> which was adapted into a popular TV drama series and <The Legendary Moonlight Sculptor (Rok Media)> which was made into a game sharing the same world from the web novel. More single sources of content are being adapted into multiple products as the ‘one-source, multi-use’ system becomes more commonplace. Recently, web novels are also being adapted into webtoons. The good thing about content that has been verified as a commercial product is that it can be offered easily to both Korean readers and users outside South Korea. Now, South Korea’s web novel market is busily moving to enter markets outside the country.

Flow chart of web novel content (Korea Creative Content Agency)

Reference material

<Ways to promote web novels based on IP business> Korea Creative Content Agency, 2018.

<Novelists no longer low-earners…annual pay 400 mln won, web novels have changed> Joongang Ilbo, 2019.08.26.

<JOY’ all-in on content, on brink of biggest IPO for tech company> The Bell, 2019.09.19.

<Social platform BritG 2nd anniversary interview ‘We want to stand in the center of genre fiction’> Newspaper, 2019.03.05.

<Dramas, games and movies…web novels’ value shoot through roof> NoCut News, 2019.09.24.

Written by Ryu Young-ho (Director of Kyobo Book Centre’s content business division)